Ramblings in todays newsletter:

✍️ The €3 Revolution: When Innovation Wears a “Made in China” Tag

💲In dollar we (don’t) trust….or at least thats where we are heading to

🪨 AI Cracks the Case of the Cave Doodlers

🌌NASA to SpaceX: "We're Seeing Other People"

The corporate tax software guide you actually need

Discover tax software that clears your desk and your mind. This guide helps you find a solution that simplifies reporting, reduces risk, and gives you more time to focus on what really matters.

Hello, and welcome to your Wednesday!

Hallo and welcome from a very busy Munich! I hope your week has been fantastic. It’s been a wild few days, and I’ve been trying to keep up with it all between sips of (what else?) strong coffee.

The biggest news, honestly, came straight from Silicon Valley. Today (Hot from the owen) OpenAI introduced ChatGPT Atlas, a new web browser built with ChatGPT at its core. More on this in the next edition. OpenAI just dropped Sora 2, their new video-gen tool that looks like actual magic, and then made ChatGPT Search free for everyone. Talk about grabbing the headlines! This AI boom lit a fire under the stock market; AMD’s stock in particular went absolutely ballistic after announcing a massive new AI deal with... you guessed it, OpenAI.

You’d think big tech has it all sorted, right? Enter Amazon Web Services (AWS), which had a global outage that knocked out everything from retail orders to banking services. Oh yes, the cloud casually tripped so the world decided to waddle for a few hours.

The S&P 500 has been climbing, so I hope your investments are looking good! Right here in Europe, things got a bit more regulated.

The EU’s new Political Advertising rules just kicked in, so we’ll finally get to see who’s paying for all those ads. About time, right?

On a more somber note from my home country, former Kenyan PM Raila Odinga sadly passed away while visiting Kerala.

Japan just opened the world’s first carbon-negative theme park, every rollercoaster ride plants a tree.

Let's get into the rest...

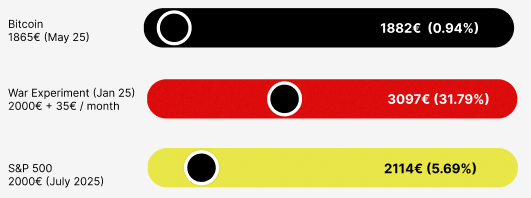

Our Money, Our Risk, Real Investment, No Advice

We pledged approx. €6000 for you to see the ups 😀 and downs 👎 And Bitcoin despite the recent rally has not recovered fully

Market Watch

Didn't the stock market get the memo about all the vibes being off lately? Despite lingering concerns over a U.S. government shutdown, continued trade tensions with China, and a little whisper of new regional bank jitters (because we definitely needed that), U.S. stocks wrapped up the week higher. The S&P 500 bounced back, fueled primarily by a stronger-than-expected start to the Q3 earnings season, about 85% of early-reporting companies are 'beating estimates.' Federal Reserve Chair Jerome Powell also chimed in with dovish comments, suggesting rate cuts are still on the table due to a "weakening labor market," which helped Treasury yields (and borrowing costs) drop, with the 10-year yield hitting its lowest point in a year.

✍️ The €3 Revolution: When Innovation Wears a “Made in China” Tag

It all started with a casual Temu scroll.

“I’ll just browse for five minutes,” I told myself.

Two hours, €82 and a week later, and my living room looked like a gadget store.

A phone holder that bends, rotates, and probably doubles as a tripod.

A bathroom shelf that folds, drains, and looks like it belongs in a design magazine, ….and the list goes on. And here’s the kicker, the quality? Shockingly good. Like, “why am I paying €200+ for the same thing on Amazon?”, good.

That’s when it hit me: we’ve been mocking “Made in China” for decades…

while they’ve quietly been innovating the small stuff → faster, cheaper, smarter.

Innovation Without Ego

In the West, “cheap Chinese products” is practically shorthand for flimsy knockoffs.

Scroll through Temu or AliExpress, and you’ll see something different: efficiency, iteration, practical genius.

A mobile stand in Europe: $29.99, minimalist, aluminum.

In China: foldable, wireless-charging, telescopic, and holds your coffee mug. Three bucks.

Kitchen racks? Europe designs museum pieces. China designs life-hacks → rotate, drain, fold, repeat.

Even Japan, king of compact cleverness, now has competition.

China is blending scale, speed, and micro-innovation in ways we rarely see outside Asia.

China Goes Deep - AI, Chips, and Tech Giants

It doesn’t stop at kitchen racks and phone holders. China is now going full-team into deep tech.

AI, semiconductors, quantum computing, you name it. They’re starting to compete with US tech giants, and often doing it cheaper, while still nearly matching the performance.

Think: affordable AI models that rival OpenAI’s tools, hardware that undercuts Western prices without giving up power, and startups churning out tech that just works.

The Temu scroll was just the tip of the iceberg. What started as micro-innovation is now macro ambition.

East vs. West Reality Check

The West obsesses over premium minimalism, €90 bottles that hold only water.

The East solves everyday problems: toothbrushes that dispense toothpaste, laptop lights that adjust automatically, accordion-style shoe racks.

No CES headlines, just better daily life. Innovation without ego…€12 gadgets that do what €200 smart homes cannot.

My Take

China is climbing the innovation ladder, one deceptively simple product at a time,and now aiming straight at deep tech dominance. Politics? That’s for their people. Innovation? That’s global.

The West? Still debating “premium design” while Asia quietly fixes your kitchen and desk and eventually our AI models maybe?

The next global disruption won’t come from a keynote. It’ll come wrapped in bright orange Temu packaging, cost €3, and make you wonder:

Why didn’t we think of that?

Footnote: Of course there will be concerns about chemicals, toxins, etc….just be intelligent about what you buy.

🌎This Day In History: 22.10.2010

WikiLeaks publishes a searchable database of more than 16,000 procurement requests posted by United States embassies around the world.

WikiLeaks, a website founded by Julian Assange that functioned as a clearinghouse for classified or otherwise privileged information, released thousands of U.S. documents relating to the wars in Iraq and Afghanistan.

INTERESTING READS💲In dollar we (don’t) trust….or at least thats where we are heading to

So, get this: the head of Europe's big bank, Christine Lagarde, went on American TV and basically dropped some bad news. She hinted that the US dollar might not be the world's #1 currency for much longer. As proof, she said smart people are moving their money out of the US (to places like Europe) and are buying gold like crazy. She also said that to be the boss currency, other countries need to trust you and you need to have strong, stable rules. Then she said the US is still "very strong" in... well, "at least one" of those. (Oof. Just one?) Finally, she warned that all those new US tariffs (extra taxes on stuff from other countries) are going to start costing you money soon. Right now, companies are just eating the cost, but they can't do that forever.

What it means:

Usually, people in Christine’s job are super boring and never say anything interesting. So, when she says the dollar is getting weaker, it's a big deal. It's like a giant flashing warning light. She's telling the US, "Hey, the rest of the world sees what you're doing, and we're starting to make other plans." And when she says the "pain" for consumers is just "a question of time," she really just means, "Get ready, because this is going to hurt." It's a nice way of saying the party might be over for the US doing whatever it wants.

Researchers at Griffith University just pulled off a wild mix of archaeology and machine learning: teaching AI to tell whether ancient cave artists were men or women, and it’s right 84% of the time. Using finger flutings, those wavy finger marks carved into cave walls by our early ancestors, the team trained image-recognition models on fresh clay and VR recreations. Turns out, the clay beats the metaverse by miles.

Some of these ancient doodles date back 300,000 years, likely drawn by Neanderthals. Past methods using finger sizes never quite worked, but AI might finally crack who really did the world’s first “wall posts.” It’s still a proof of concept, but the researchers are sharing their code so others can refine this digital archaeology breakthrough. Prehistoric art just went high-tech.

🌌NASA to SpaceX: "We're Seeing Other People"

In the most dramatic "it's not me, it's you" of the space race, NASA officials have stated they are actively looking for other companies to build lunar landers for the Artemis program. Why? Because, according to the space agency, Elon Musk's SpaceX is "behind" on its timeline for delivering the all-important Starship, which is supposed to ferry astronauts to the Moon's surface.

NASA's head, Bill Nelson, has been pretty blunt, saying the agency won't "wait for one company" as it pushes to get astronauts back to the moon before China does. This opens the door wide for competitors like Blue Origin to snag a piece of that very lucrative lunar pie. SpaceX, for its part, just keeps blowing up Starship prototypes, which it calls "rapid iterative testing."

Why it matters: This is a big deal. For years, SpaceX has been the undeniable golden child of the private space industry. This is the first public crack in that armor, with NASA basically putting Musk on notice. It’s fantastic for competition, as it lights a fire under everyone to build a working moon lander. But it also highlights the immense risk of betting our entire return to the moon on one company's very, very large (and very explosive) rocket.

PODCAST THIS WEEKThis podcast is a rather casual one with some interesting insights on what Sam Altman thinks when it comes to AI in the future.

He put it quiet well, companies that will survive AI will be the ones who will create vaule on top of AI which AI model providers themselves would not do, like Uber on the phone and not the thirdparty flashlight app on the iPhone.

Stuff to tickle your brains!IN OTHER NEWS

Elon Musk just dropped a bombshell, his Grok AI is set to replace X entirely, turning the platform from a social network into a full-blown AI-powered super app. 🚀

OpenAI just made another acqui-hire move and officially entered the FinTech arena by acquiring Roi, a New York-based AI-powered personal finance startup founded in 2022.

While Americans shop at Walmart, the retail giant is buying malls. Walmart recently purchased a retail plaza in Norwalk, CT, for $44.5 million, outbidding others with a strong offer. This move from lessee to owner is part of a growing trend, as Walmart already owns most of its locations.

25% Higher Transaction Rates Among Millennial And Gen Z Cardholders. Millennials and Gen Z now account for 36% of total spend, making up the same share as Gen X

NASA reports that global sea levels rose faster than expected in 2024, reaching their highest levels in 30 years as the planet recorded its hottest year on record. The rise was 0.59 centimeters per year, far above the projected 0.43 centimeter.

An AWS earthquake gave the internet a very bad day

🧠 Trivia of the Day

🧠 Did you know? The inventor of the microwave, Percy Spencer, discovered it by accident when a chocolate bar melted in his pocket while he was working on radar equipment. 🍫⚡ Sometimes science just heats up unexpectedly.

Wishing you a productive week ahead!

The Mimimum Viable Product Team: Amod, Damian, Vlad and Ferdinand read your emails and comments daily.

For each referral you drive, you will unlock rewards when you hit milestones. If you recommend 10 of your friends we will send you a personalised cups of your choice from this shop for free: https://muenedesign.etsy.com