Show me the incentive and I will show you the outcome - Charlie Munger

💡 Did you know?

The $520 Billion Backbone of Modern Industry

As of Q4 2023, the global semiconductor market reached an estimated valuation of $520 billion, underlining its role as the critical "crude oil" of the digital age. This massive valuation reflects the escalating demand for advanced logic chips required to power generative AI, high-performance computing, and the electrification of the automotive sector.

Tech Talk

In the world of tech, we’re witnessing the death of the "I forgot my ID" excuse. On January 28, India officially unleashed its next-gen Aadhaar App, a digital identity that lets users selectively share credentials via QR codes, think of it as a "need to know" basis for your data. Meanwhile, Samsung is making us all look a little more like we're living in Minority Report by launching glasses-free 3D digital signage at ISE 2026.

On the AI front, the industry's obsession with "who's winning" continues to shift; while OpenAI and Microsoft remain the titans to beat, the focus this week has pivoted to "software survival" as businesses scramble to integrate these tools before they become the next digital fossil. Also, a quick nod to Samsung’s newest eco-flex: a color e-paper display made from phytoplankton bio-resin. It’s tech you can technically feel good about, provided the algae don't mind.

Science Scoop

Humanity might actually have a shot at a better tomorrow, thanks to a "single-shot" HIV vaccine breakthrough reported by Wistar scientists on February 3. If that’s not enough to make you smile, researchers at KAIST discovered a way to reprogram a tumor’s own immune cells into "cancer killers" directly inside the body. It’s basically training the bad guys to turn into the Avengers.

Up in the stars, the Sun has been throwing an absolute tantrum; monster sunspot AR4366 released a staggering X8.1 flare this week, providing a spectacular show for satellites and a mild headache for radio operators. Back on Earth, scientists discovered nearly 800 new species in the deep Pacific, a timely reminder that there’s still a whole "hidden world" worth protecting before we start vacuuming the seabed for minerals.

The Rest of the World

Geopolitics got personal this week as Donald Trump met with Colombia's Gustavo Petro in Washington to discuss the "Big Four": drugs, migration, China, and Venezuela. It’s a high-stakes diplomatic dance with a lot of room for stepping on toes.

In the Middle East, there was a rare flicker of hope as the Rafah crossing partially reopened, allowing a trickle of people to move through the gates for the first time in nearly two years. However, the week wasn't without its tragedies; a massive landslide at the Rubaya mines in the DRC claimed at least 200 lives, a sobering reminder of the human cost behind our global supply chains. On a lighter note, if you’re looking for a distraction from the chaos, the Venice Carnival has officially kicked off, proving that no matter how weird the world gets, humans will always find an excuse to put on a mask and party in the street.

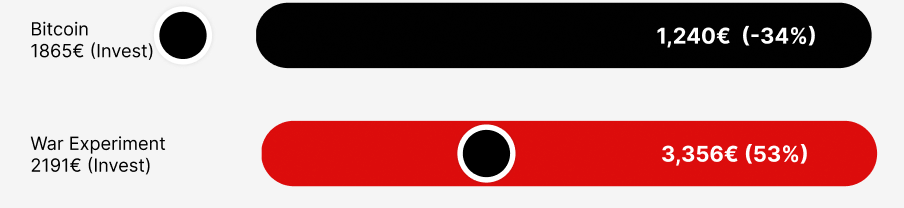

Our Money, Our Risk, Real Investment, No Advice

We pledged approx. €2000 for you to see the ups 😀 and downs 👎. And Bitcoin certainly had a down week!

January 28 to February 3 2026: A Week of Budget Battles and Crypto Bruises

The last seven days felt like watching a high stakes poker game where everyone keeps raising the stakes despite holding a pair of twos. We kicked things off with the Federal Reserve playing it cool and holding rates steady, which the market greeted with a collective shrug. But as we flipped the calendar to February, the mood shifted from a sleepy waiting room to a chaotic gymnasium.

In the U.S., the S&P 500 danced around the 7000 mark like a nervous teenager at a prom, eventually taking a bit of a tumble today as tech heavyweights decided to catch a cold. Meanwhile, over in Europe, the Stoxx 50 was busy hitting all-time highs thanks to a sudden love affair with mining stocks and some better than expected inflation data from France. India had the most theatrical week of all, with the Nifty 50 bracing for a special Sunday Budget session that saw stocks swinging wildly before finding some green ground today.

The $1000 Investment Story

A $1000 bet on a global basket a week ago would have grown by about $12 thanks to some heavy lifting from overseas. Your American stocks essentially ran in place before tripping over their own shoelaces today, and your European and Indian slices provided the actual growth as they cheered on record highs and budget optimism respectively. Your Bitcoin slice, however, acted like a moody teenager who just got their phone confiscated. It spent most of the week sulking in the basement, dropping from the mid $80,000s down to the $75,000 range and dragging the portfolio’s vibe down with it. It was not a jackpot, but at least the diversify or die mantra kept you from ending the week in the red.

Fund Summary

The global market is currently like a group of hikers trying to navigate a foggy trail: they are moving forward with plenty of gear, but every time a twig snaps in the woods, they contemplate turning back to the car. We are seeing plenty of record highs in specific corners, yet the overall sentiment remains a mix of stubborn optimism and "don't look down" vertigo.

Xiaomi’s SU7 Ultra, the 1,500-horsepower electric beast designed to crush Nürburgring records, is currently crushing something else: its own sales momentum. After a massive hype cycle and 3,600 pre-orders in the first ten minutes, actual deliveries have cratered. In the final week of January, Xiaomi reportedly moved fewer than 50 units. While the standard SU7 sedan is still a massive hit, the $110,000 "Ultra" version is finding out that the market for track-ready EVs from a smartphone company is smaller than a TikTok attention span.

My Take: Turns out that building a halo car is easy, but finding thousands of people willing to drop Porsche money on a Xiaomi-badged rocket is a bit tougher. It’s the classic "I’ll definitely buy that" internet energy that evaporates the second the credit card needs to come out of the wallet. Xiaomi wanted to prove they could out-engineer the Europeans, and they did. They just forgot that at this price point, people buy a badge and a legacy, not just a 0-60 time that liquefies your organs. It’s a spectacular piece of tech, but right now, it’s looking nothing more than an expensive billboard saying we have arrived!

Why It Matters: This is a reality check for the "premium" ambitions of Chinese tech giants entering the auto space. The novelty of a phone-on-wheels wears off quickly once you cross the six-figure threshold. Xiaomi needs the Ultra to be a brand-builder, but if sales don't stabilize, it risks becoming a cautionary tale about overestimating how far brand loyalty can stretch. It also signals that even in the world’s most aggressive EV market, there is a very real ceiling for high-performance electric toys.