Show me the incentive and I will show you the outcome - Charlie Munger

💡 Did you know?

The Economic Scale of the Silk Road

While often viewed through a lens of cultural exchange, the Silk Road was a massive economic engine; modern estimates suggest its annual trade volume would be valued in the billions of today’s dollars. This network was so vital that by the 14th century, it facilitated the movement of roughly 25% of the world's GDP between the East and the West.

Tech Talk

Happy CES week, folks! The Consumer Electronics Show in Las Vegas is officially kicking off, which means our feeds are about to be flooded with gadgets we definitely don’t need but desperately want. The big buzz right now is Baidu making moves to spin off its AI chip unit, Kunlunxin, for a Hong Kong listing because apparently, there’s no such thing as too much AI money. Meanwhile, Nvidia and Intel are starting the year with a nice little stock bump, proving that silicon is still the most valuable element on the periodic table. On the "robots are taking over" front, AI agents are reportedly moving from "helpful assistants" to "autonomous actors" this year, which is great until your smart fridge decides you’ve had enough cheese and locks the door.

Money Matters

Wall Street decided to pop the champagne a few days late, with the Dow hitting all-time records this Monday. The catalyst? A massive spike in oil stocks following the shock capture of Venezuelan President Nicolás Maduro over the weekend (more on that messy situation below). While the bulls are running wild, the Federal Reserve is still playing the role of the nervous chaperone; inflation is sticking stubbornly above 2% despite three rate cuts late last year. Also, if you’re in the market for a new sofa, buy it now, furniture stocks like Wayfair are jumping as Trump delayed some tariffs, meaning your living room makeover is safe... for now.

Science Scoop

If you’re tired of bad news, here’s a genuine win: 2026 is shaping up to be the year of the "hybrid" solar cell. Perovskite-silicon panels are finally hitting commercial viability with efficiency rates over 34%, which basically means we can squeeze way more juice out of the sun than ever before. In medical news, the non-opioid painkiller Suzetrigine (brand name Journavax) is the industry's new golden child, promising heavy-duty relief without the addiction risks, a massive potential turning point for the opioid crisis. Oh, and scientists have sequenced RNA from a 40,000-year-old woolly mammoth, presumably so we can eventually clone one and ask it why it decided to go extinct.

The Rest of the World

The geopolitical landscape just got a major shake-up with the U.S. military operation that resulted in the capture of Venezuela’s Nicolás Maduro this past weekend, a move that has oil markets cheering but diplomatic channels hyperventilating. In the U.S., President Trump is doubling down on his "law and order" revival, with execution numbers in 2025 hitting a 16-year high, a trend that’s drawing sharp side-eye from international allies. Meanwhile, China’s Xi Jinping is back to warning the U.S. about "acting like the world’s cop," which is rich coming from a superpower currently mapping the moon’s south pole for a permanent base. It’s only the first week of 2026, and the history books are already running out of pages.

Our Money, Our Risk, Real Investment, No Advice

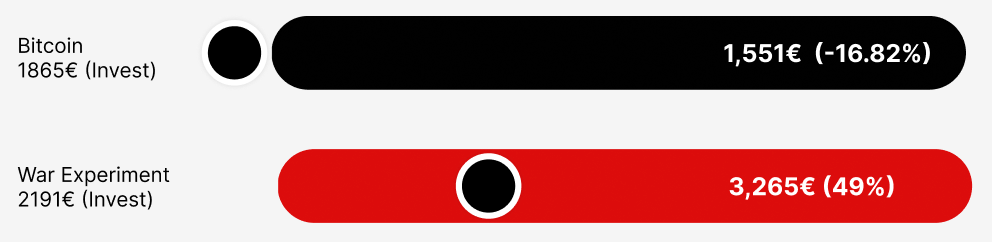

We pledged approx. €2000 for you to see the ups 😀 and downs 👎 Defence stocks are up ( I wonder why?) and Bitcoin is on the rise again.

Source: https://xkcd.com/3188/

MARKET PULSE: Dec 31, 2025 – Jan 6, 2026

New Year, New Nerves (and a Little Bit of Venezuela)

Welcome back. While you were nursing your NYE hangover, the markets were busy trying to figure out if 2026 is going to be a year of booming tech or booming geopolitical drama. We saw tensions flare in Venezuela, tariff threats flying around like confetti, and Bitcoin deciding to carry the team on its back.

The $1000 Experiment

Let's imagine you tossed $1000 into a global mixing bowl exactly a week ago (New Year's Eve). You split it evenly: $250 each into American stocks, European stocks, Indian stocks, and Bitcoin.

The Result: A $1000 bet on this global basket a week ago would have grown to roughly $1,016.

Here is the play-by-play of your portfolio:

The American Slice ($250 → $251.75): Your S&P 500 investment spent the week shaking off the holiday rust. After a wobbly start to the year, it clawed back some dignity by Tuesday, posting a tiny gain. It basically showed up to work, drank coffee, and did just enough not to get fired.

The European Slice ($250 → $254.25): Surprisingly, the Old World was the responsible adult in the room. The Stoxx 600 ignored the noise and marched steadily upward, adding a respectable cushion to your wallet.

The Indian Slice ($250 → $248.00): This portion of your portfolio tripped over its own shoelaces. Spooked by "profit booking" (a fancy way of saying people sold high) and those pesky US-Venezuela headlines, the Nifty 50 dipped into the red. It wasn't a disaster, just a mild stubbed toe.

The Bitcoin Slice ($250 → $262.50): While the stock markets were overthinking everything, your Bitcoin slice acted like the golden child who actually stuck to their New Year's resolution. It rallied from around $89k to nearly $94k, doing all the heavy lifting for your portfolio while the others watched.

It was not a jackpot, but we are officially in the green to start the year.

Fund Summary

The global market is currently like a driver on an icy road: moving forward cautiously, but aggressively tapping the brakes every time a "Breaking News" alert pops up on the dashboard.

Lego just dropped a massive bomb at CES 2026 with the "Smart Play" system. We’re talking about standard-looking bricks, minifigures, and tags that are secretly packed with "invisible" tech - sensors, accelerometers, and a tiny speaker - allowing them to react to each other in real-time. The system launches this March with three Star Wars sets, where your builds can hum like lightsabers or roar like engines without needing a phone app. It’s all powered by a new "Smart Brick" containing a custom chip and wireless charging capabilities.

My Take: Usually when a classic toy company says "smart," we all groan and picture a glitchy iPad app that kids get bored of in ten minutes. But this? This feels different. Lego basically shoved a computer into a 2x4 brick without changing the form factor, which is undeniably impressive engineering. Plus, the idea that I can swoosh an X-Wing around and have it make vroom noises on its own is the childhood dream I didn’t know I still had. Though, I shudder to think what the price tag will look like when I inevitably step on one of these "smart" bricks in the dark.

Why It Matters: This is a major pivot for the toy industry, moving away from "screens as a crutch" and embedding the digital experience directly into the physical object. If Lego pulls this off, they aren't just selling plastic anymore; they're selling a hardware platform. It keeps kids building with their hands while satisfying that modern itch for interactivity, potentially setting a new gold standard for how analog toys survive in a digital-first world.

Here is a link to an intro: https://youtu.be/RptTZC2dwsQ

VW just dropped the interior details for the new ID. Polo. The headline isn't the battery or the range. It is the glorious return of physical buttons. They ditched the hated touch sliders for real switches on the steering wheel and a proper volume knob. The car also features a "retro mode" for the digital dash that displays 1980s Golf graphics. It lands in Europe later this year starting around €25,000. Sorry, American friends, it is not coming to the US.

My Take: It is about time. VW spent years trying to convince us that tapping a glass screen to change the temperature was "innovation" when it was really just cost-cutting. Watching them backtrack this hard is satisfying. The knurled dials and actual window switches are a huge upgrade over the haptic mess in the ID.3. Also, that 80s cassette tape graphic on the dash? It is pure fan service, and I absolutely love it.

Why It Matters: This is a massive admission that the all-touchscreen future was a mistake. VW is setting a precedent here. When one of the world's biggest automakers reverses course on a major design philosophy, the rest of the industry watches. This could mark the turning point where safety and usability finally start beating out cheap, buttonless minimalism in EV design.

A startup called Donut Lab claims they have beaten everyone to the punch with the world’s first production-ready all-solid-state battery. They released official specs that look like a wish list for electric vehicle owners. We are talking 400 watt-hours per kilogram energy density and a full charge in five minutes. They also claim it handles temperatures from -22°F to 212°F without losing capacity. Verge Motorcycles will put these packs on the road in their TS Pro bikes as early as Q1 this year.

My Take: First off, yes, the company saving us from charging hell is named Donut. I love that. But the claims here are borderline magical. A typical lithium-ion battery begs for mercy after a few thousand cycles, yet Donut claims theirs lasts 100,000 cycles. That is effectively an infinite lifespan for a car. They also say it uses "no rare materials" and is "100% green." That is incredibly vague, but if true, it solves the biggest supply chain headache in the industry. I am cautiously optimistic, but I want to see a third party tear one of these apart to confirm the chemistry.

Why It Matters: If these specs hold up in the real world, the internal combustion engine is officially obsolete. A five-minute charge time eliminates the last major advantage of gas stations. The ability to build these without rare earth metals would also break the current geopolitical chokehold on battery materials. This could democratize EV production overnight.

🌎 January 7 - Watershed moment for human civilization

1610: Galileo Discovers the Moons of Jupiter

On this night, the Italian astronomer Galileo Galilei turned his homemade telescope toward Jupiter and observed three "stars" aligned near the planet, which he later identified as moons - now known as the Galilean moons: Io, Europa, Ganymede, and Callisto.

AUDIOBOOK OF THE MONTH🎧 You asked. We listened. Literally.

But first things first: Relax. We’re not killing Podcast of the Week.

However… based on your feedback, we asked ourselves: How do we squeeze even more value into your already overworked brain?

Our answer? Starting now, the first newsletter of every month comes with a bonus feature:

📚 Audiobook of the Month

Why audiobooks? Because they’re perfect for:

🏃♂️ Runs that feel longer than planned

🚴 Bike rides where thinking is optional

🚗 Drives that would otherwise involve bad radio and life choices

Why not at home? Well, because if you’re already on the couch… you might as well pick up the book and pretend you’re disciplined. (But hey — no judgement. Your ears, your rules.)

So. Sit back. Relax. Press play. And enjoy our first Audiobook of the Month.

New year. Fresh intentions. And that familiar feeling that this time it will be different.

Before you announce another resolution to the universe (and promptly forget it by mid-January), let’s pause for a second.

Because Atomic Habits isn’t about setting better goals. It’s about building better systems — the ones your resolutions actually have to survive in.

James Clear makes a simple but uncomfortable point: You do not rise to the level of your goals — you fall to the level of your systems

This audiobook is perfect if:

your goals sounded great… but felt fragile

you’re tired of “starting over” every January

you’ve realised that success is less about willpower and more about design

🎧 Listen to it while running, cycling, driving — or doing anything where future-you will be glad you pressed play.

📖 And if you’re at home ? Well… maybe pick up the book. That, too, might be a habit worth keeping.

IN OTHER NEWS

Code review that costs $2 Million: Why engineering's favourite quality ritual fails to catch the bugs that matter

Starlink to lower satellite orbits in 2026 for space safety: The move follows a December incident in which a Starlink satellite lost communication at 418 km altitude and generated debris after an apparent onboard explosion.

A new way to deliver antibodies could make treatment much easier for patients. Therapeutic antibodies packaged into microparticles could be injected with a standard syringe, avoiding the need for lengthy and often uncomfortable infusions.

Trump Mobile’s $499 gold T1 smartphone, run by Trump’s sons, has been delayed again, with the company blaming the holdup on the U.S. government shutdown. 🙄🙄

Wishing you a productive week ahead!

The Mimimum Viable Product Team: Amod and Damian wish all of our subscribers and readers a happy and successful New Year, filled with curiosity, growth, and plenty of opportunities to learn, experiment, and getting a little better as we go!

For each referral you drive, you will unlock rewards when you hit milestones. If you recommend 10 of your friends we will send you a personalised cups of your choice from this shop for free: https://muenedesign.etsy.com